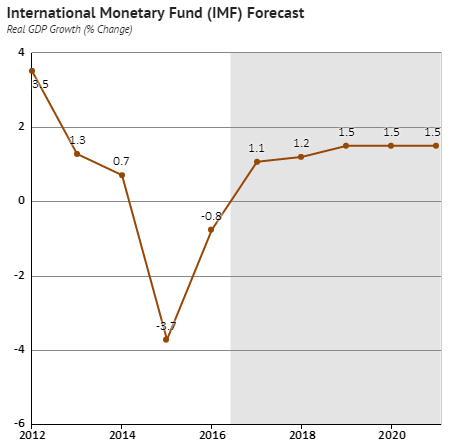

Imf banking penetration

Events High Level Forum on Strengthening Islamic banking regulation and supervision in the Arab region ; May 22 — 23, , Dubai, United Arab Emirates Islamic Finance Conference: The Central Bank of Kenya CBK says that by the end of September, the local banking sector had total assets of Sh3. Rwanda was not ranked. Recent Developments Islamic Banking Sukuk. Even though the country is not high up in commercial banking, the report notes that its strength lies in the usage of mobile phones to access financial services. The Rise of Islamic Finance and Its Potential for Africa March 03, Resources on Islamic Finance Monetary Policy in the Presence of Islamic Banking Resolution Frameworks for Islamic Banks Monetary Operations and Islamic Banking in the GCC:

Events High Level Forum on Strengthening Islamic banking regulation and supervision in the Arab region ; May 22 — 23, , Dubai, United Arab Emirates Islamic Finance Conference: The Central Bank of Kenya CBK says that by the end of September, the local banking sector had total assets of Sh3. Rwanda was not ranked. Recent Developments Islamic Banking Sukuk. Even though the country is not high up in commercial banking, the report notes that its strength lies in the usage of mobile phones to access financial services. The Rise of Islamic Finance and Its Potential for Africa March 03, Resources on Islamic Finance Monetary Policy in the Presence of Islamic Banking Resolution Frameworks for Islamic Banks Monetary Operations and Islamic Banking in the GCC:

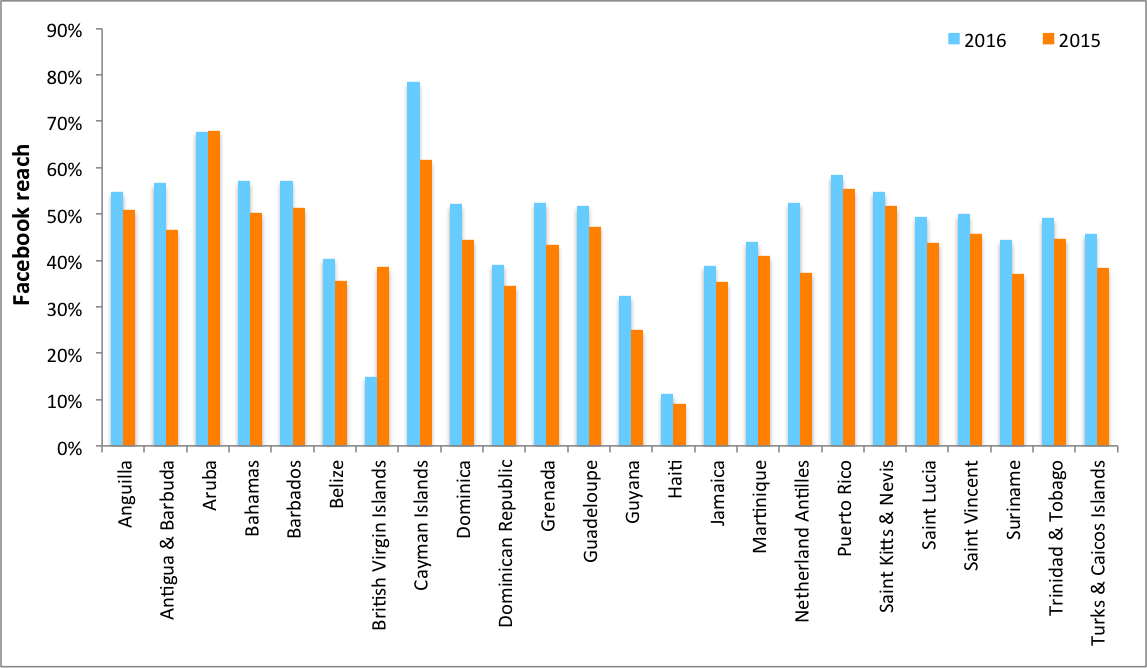

Mobile Phone Penetration

They can be shared, prepaid, billed in prices per second, depending on the needs and abilities of the owner s. Unlocking its Potential and Supporting Stability. Your feedback is very helpful to us as we work to improve the site functionality on worldbank. Sukuk, the Islamic equivalent of bonds, are similar to asset backed securities and differ from conventional bonds in a number of ways. However, more than half of the poorest 40 percent in developing countries are still without accounts. While there, we will immerse ourselves in the latest research, trends and conversations about mobile communications.

They can be shared, prepaid, billed in prices per second, depending on the needs and abilities of the owner s. Unlocking its Potential and Supporting Stability. Your feedback is very helpful to us as we work to improve the site functionality on worldbank. Sukuk, the Islamic equivalent of bonds, are similar to asset backed securities and differ from conventional bonds in a number of ways. However, more than half of the poorest 40 percent in developing countries are still without accounts. While there, we will immerse ourselves in the latest research, trends and conversations about mobile communications.

Benigna. Age: 24. I dress elegantly and have the sexiest lingerie and costumes..my imagination is endless when it comes to pure lust and i love to play with all kinds of toys.

Mobile Phone Penetration | World Bank Blogs

List of countries by mobile banking usage

Description: Back to top Recent Developments Islamic finance currently encompasses banking, leasing, Sukuk securities and equity markets, investment funds, insurance "Takaful" and micro finance, but the banking and Sukuk assets represent about 95 percent of total Islamic finance assets. The operations of Islamic banks give rise to a unique set of risks, in addition to the standard risks associated with banking activities such as credit, market, liquidity, operational and legal risks. Back to top What Is Islamic Finance? The IMF established an External Advisory Group , comprised of standard-setters for Islamic finance and leading international experts, to assist in identifying policy issues and to enhance coordination with different stakeholders interested in Islamic Finance. New developments and curiosities from a changing global media landscape:

.jpg)

User Comments

Post a comment

Comment: